In the 3 months since the nationwide lockdown commenced in late March, the Prideview team has dealt with an unexpected surge in enquiries and transactions on behalf of our opportunistic and shrewd client base.

The result has been 22 completions and exchanges in this period, totalling in excess of £20M.

Transactions range from hassle-free investments to proper asset management deals. To offer private investors invaluable insight into what is trading in the current market, how deals are being done and most importantly what prices / yields are being paid, we have decided to publish the details of these below. Do also watch the highlights below of a recent conversation between Vishal, Mark and Pritesh regarding which investments are most sought after currently.

In addition, at the time of publication (June ’20), we have another 20 deals under offer, totalling in excess of £35M. ‘Under offer’ deals are acquisitions or sales which are currently in the legal process (e.g. heads of terms issued / searches applied for / enquiries being made / valuations taking place etc) but which have not yet exchanged (and to be clear, may never).

It would be great to know your thoughts on the key question of the moment – is now the time to buy?

Completions

Co-op Food, Canary Wharf, Greater London

- Virtual Freehold Blue-chip Convenience Store investment in London

- Ground floor retail unit let to Co-op Food for 15 years from Oct ’15

- Within a large residential development adjacent to a number of residential towers

- Private Sale marketed at £1.9M

- Sold for £2M / 5.3% gross

Sainsbury’s Local, Pharmacy & Restaurant, Wootton

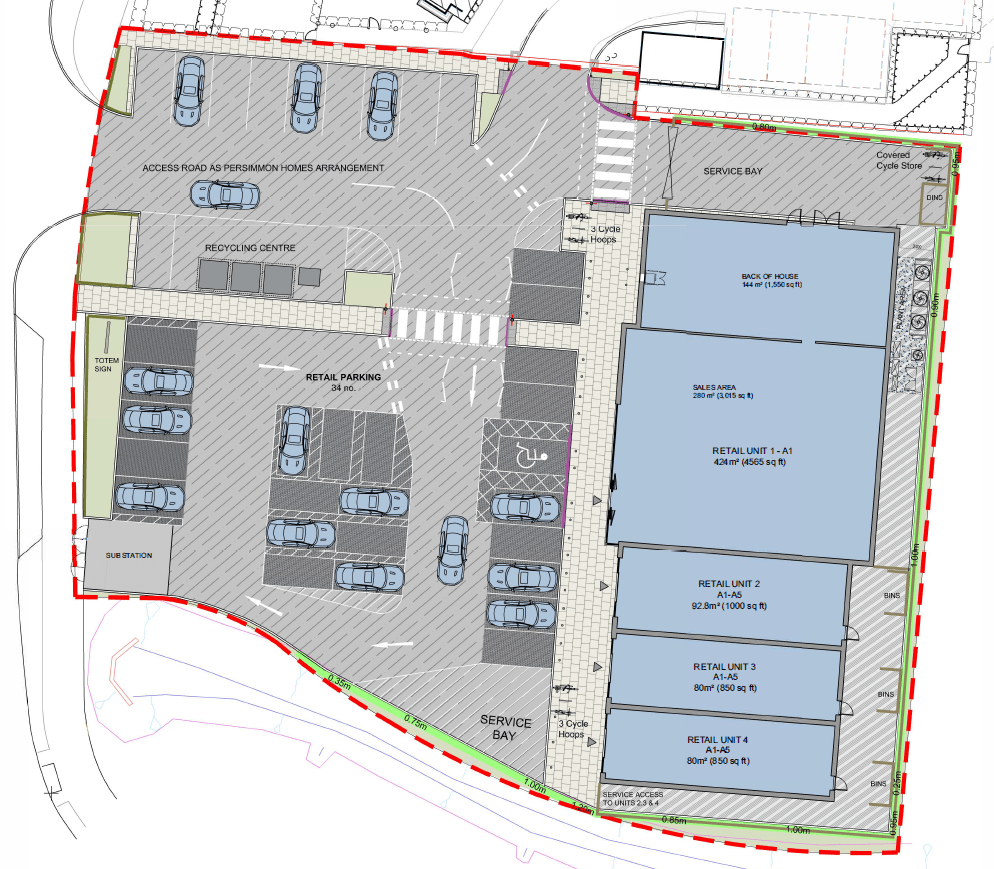

- Freehold New-Build Forward-Funded Parade Investment

- 15 year Sainsbury’s Local, Pharmacy & Fish & Chip shop

- Within a new build housing development outside Bedford

- Off-market deal: ca. £2.1M / 6.25%

Optician, Blackwood, Wales

- Virtual Freehold Medical investment

- Let to an independent optician for 15 years from Sep ’19 with breaks in the 5th and 10th year

- Town centre location in a busy Welsh town

- Auction Guide Price: £100,000 – £120,000

- Acquired prior: £120,000 / 12% gross

McColl’s, Watford, Greater London

- Freehold Blue-chip Convenience Store & Residential investment in Greater London

- Let to Martin McColl Ltd until 2034 (no breaks)

- On a busy neighbourhood parade

- Auction Guide Price: £800,000 – £850,000

- Sold Prior: ca. £900,000 / 5.6% gross

McColl’s, Norwich

- Freehold Blue-chip Convenience Store investment

- Let to Martin McColl Limited until 2035 (no breaks)

- Village centre location

- Sold by private treaty: ca. £300,000 / 6.25%

Office, Pinner, Greater London

- Virtual Freehold 1,000 sq.ft. office

- High street location in affluent London surburb

- Off-market deal: ca. £300,000

Heron Foods, Sheffield

- Freehold Blue-chip Convenience Store investment

- Brand new store let to Heron Foods Ltd 15 years with a break in the 10th year

- Suburban location

- Off-market deal: ca. £650,000 / 7.5% gross

Dry Cleaner & Vacant Flat, Wembley, Greater London

- Freehold Retail investment with value-add potential in Greater London

- Ground floor let to a dry cleaner until 2029

- Maisonette above has potential to be converted into 2 flats

- Sold by private treaty: ca. £400,000

McColl’s, Buxton

- Freehold Blue-chip Convenience Store investment

- Let to Martin McColl Limited until 2034 (no breaks)

- Town-centre location

- Auction Guide Price: £575,00 – £600,000

- Sold in Auction: £605,000 / 6.6% gross

Exchanges

JD Sports & Costa Coffee, Harrow, Greater London

- Freehold Blue-chip Retail & Restaurant investment

- Let to JD Sports and Costa for a weighted unexpired lease term of 4.5 years

- Prime location within a large London suburban town centre

- Acquired privately: £2.3m / 7.8% gross

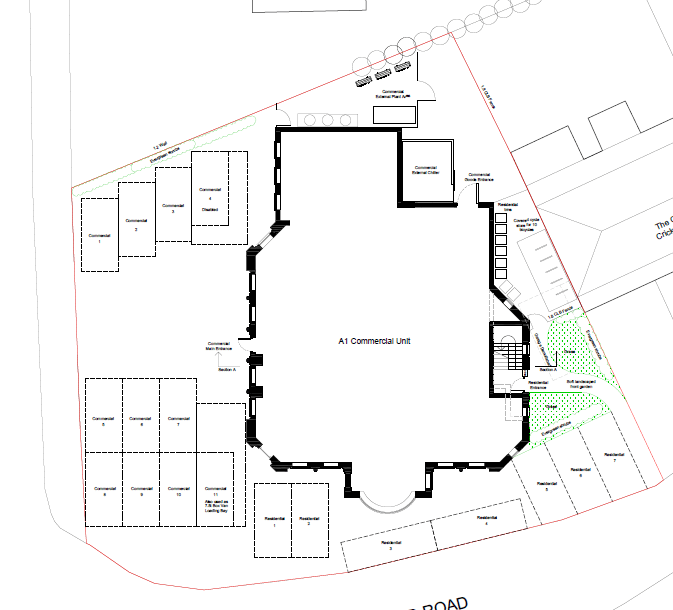

Site with Planning for a Blue-chip Convenience Store with Flats, Surrey (Confidential)

- Freehold vacant restaurant on a large site

- With planning for 7 flats and agreement to lease in place

- Buyer will develop from completion with ‘practical completion’ expected in summer 2021

- Acquired off-market: ca. £1.5m

Co-op Food, Loughborough

- Freehold Blue-chip Convenience store & Residential investment

- Retail unit Let to Central England Cooperative Ltd on a FR&I lease until November 2030

- Flat let on a separate AST

- Residential location

- Acquired Off-Market: ca. £1m / 7% gross

Funeral Partners & Vacant Flat, Queensbury, Greater London

- Freehold Medical and Residential Investment in London

- Ground floor let to Funeral Parlours Ltd on a new 15 year FR&I lease

- Vacant 1st & 2nd floor maisonette

- Established commercial parade in Queensbury, a popular north-west London suburb

- Auction Guide Price: £625,000 – £650,000

- Sold in auction: £645,000

Blue-chip Convenience Store Investment, West Midlands (Confidential)

- Freehold Blue-chip Convenience Store investment

- Let to a national supermarket for 10 years FR&I

- Densely populated residential suburb

- Acquired off-market: ca. £600k / 7% gross

Barclays, Hyde, Greater Manchester

- Freehold Bank Investment

- Large property with 2 years term certain

- Town centre location

- Sold Post Auction: ca. £250,000 (12% gross)

Tesco Express, Bewdley

- Freehold Blue-chip Convenience Store investments

- Let to Tesco Express until 2034 (TBO 2024)

- Town-centre location

- Auction Guide Price: £850,000 – £8750,000

- Sold Prior: ca. £950,000 (6.5% gross)

Iceland, Nottingham

- Freehold Blue-chip Supermarket investment

- 8,500 sq ft single unit & 55 parking spaces

- Let to Iceland Foods Ltd until Feb ’30

- Predominantly residential area & next door to Aldi

- Acquired off-market: ca. £1.6M / 7.25%

Iceland, Northampton

- Virtual Freehold Blue-chip Supermarket investment

- 8,858 sq ft single storey unit

- Let to Iceland Foods Ltd until 2030

- On a busy road in a dense residential area

- Acquired off-market: ca. £2.2m / 7.25%

Vacant Former Optician & Flat, Wembley, Greater London

- Freehold Retail and Residential Investment in London

- Ground floor retail accommodation, basement storage accommodation and a studio flat

- Prominent location on Wembley’s very busy Ealing Road.

- Auction sale: Guide price of £750,000 (was previously £900,000)

- Sold prior: ca. £750,000

Land, Tipton

- Roadside Land Development Opportunity

- Site with potential to build a commercial development of ca. 8,000 sq ft STP

- Sold by Private Treaty: ca. £150,000

Vacant Shop & Flat, Feltham, Greater London

- Freehold Mixed Investment

- Value-add opportunity needing to be modernises and re-let

- Secondary main road location serving a densely populated London suburb

- Acquired Off Market: ca. £350,000

Barclays, Driffield

- Freehold Bank Investment

- Large property with 2 years term certain

- Town centre location

- Sold Post Auction: ca. £350,000 (10% gross)

We trust the above demonstrates the range of investments, value-add and development opportunities we deal in, as well as the continued interest in UK real estate, in spite of these uncertain times. This is also a testament to our extremely professional and adaptable team, who have maintained our high service levels throughout this unprecedented period of change.

So whether you are looking to buy or sell, or act for anyone in this position, please reach out to us by filling in the contact form below and one of our capable team members shall be in touch.