We attended a very interesting breakfast seminar this week hosted by Acuitus Auctions for their main vendors.

The seminar launched the quarterly Commercial Property Auction Data (CPAD) report which analyses sales in the December 2015 round of commercial auctions. Click here to read it.

Also discussed were the results of Acuitus’s last auction in February, which posted one of the highest sales rates of any commercial auction in 20 years – 99%! Incidentally, the highest rate – 100% – was set by Barnett Ross just a few days later.

Consequently, some of the highlights, which we would like to share with our private investors, give us a very up to date view of the market – useful given that Spring ’16 is traditionally a very busy time for property investment.

Regions

- 85% of lots sold at Acuitus’s last auctions were in the Regions. As we have now been saying for several years, investors need to look outside of London if they want to secure a half-decent return

- UK retail outside the South East has been one of the slowest growing commercial property asset classes. Therefore an opportunity exists to make money as valuations in many towns are still low, but remember even in the worst towns do prime properties and prime locations exist, and they can be undervalued.

- Clearly this strategy is not without risk, as retail is a challenging area, but with the right advice private investors can secure good deals in lesser-known areas.

- Anyone who looks at auctions will find very few investments let to blue-chip tenants with leases above 10 years

- For private investors who don’t have much time outside of their core businesses, such investments present too much risk

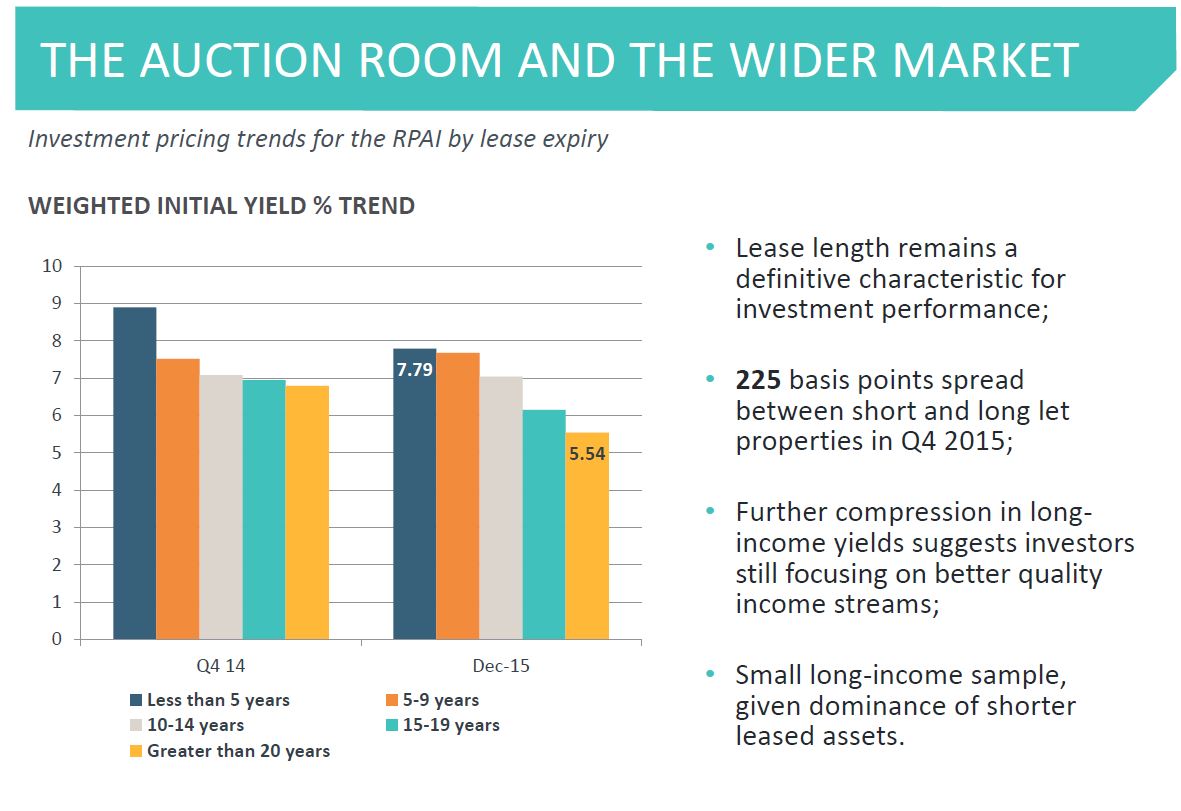

- For the small sample of properties with longer leases, the data shows that properties with lease lengths of 10-14 years sold for ca. 7% and those with 14-19 year leases sold for ca. 6%

- Clearly, lease length is not the only driver of value, but if you find a property let for 15 years in a good location at a reasonable rent, and it’s available for around 6%, then you have done well.

- The main tenants offering these lease profiles (without breaks) that we like are convenience store operators Co-op Food and McColls – talk to us about acquiring properties let to this calibre of tenant

Finance

- The finance market is currently in a good place. Lending is readily available, interest rates are low and LTVs are not dangerously high

- Interest rates are not expected to rise in 2016, and finance-wise you can expect to get rates of 2-3% over Base (currently 0.5%)

- Up to 60% LTV is available for short lease (i.e. riskier) properties otherwise 70-75% is possible for the typical blue-chip investments we specialise in sourcing

- Historically low fixed rates are also available – these are ideal for long term investors, but would depend on the size of the loan

Private Investor market

- The private investor market now seems to be fully coming into play for numerous reasons

- Increasingly punitive taxes for residential buy-to-let investors is forcing more small investors to consider commercial property

- There is a perceived strengthening of the occupier market – employment is high, incomes are rising and so is confidence

- Improved borrowing terms as outlined above make commercial property investing more rewarding

- Instability in the financial markets makes investing in stocks less attractive

The event concluded with a wise saying: “Good advice isn’t cheap but poor or no advice is more expensive” – if you are looking to invest in commercial property and want something secure with a fair return, we are the specialists and would be able to help.

To discuss more, contact Nilesh on [email protected] or 0203 113 2142