Our annual Property Investors’ Dinner was a huge success with over 100 private investors assembling to hear the Prideview team and Allsop, the leading commercial property auctioneers, deliver a fascinating presentation on the basics of commercial property investment and the market today.

Click here to see the pictures from the event and and to download Prideview’s seminar notes click here.

After a champagne reception all guests took their seats to hear George Walker, senior partner and auctioneer at Allsop giving his view from the podium.

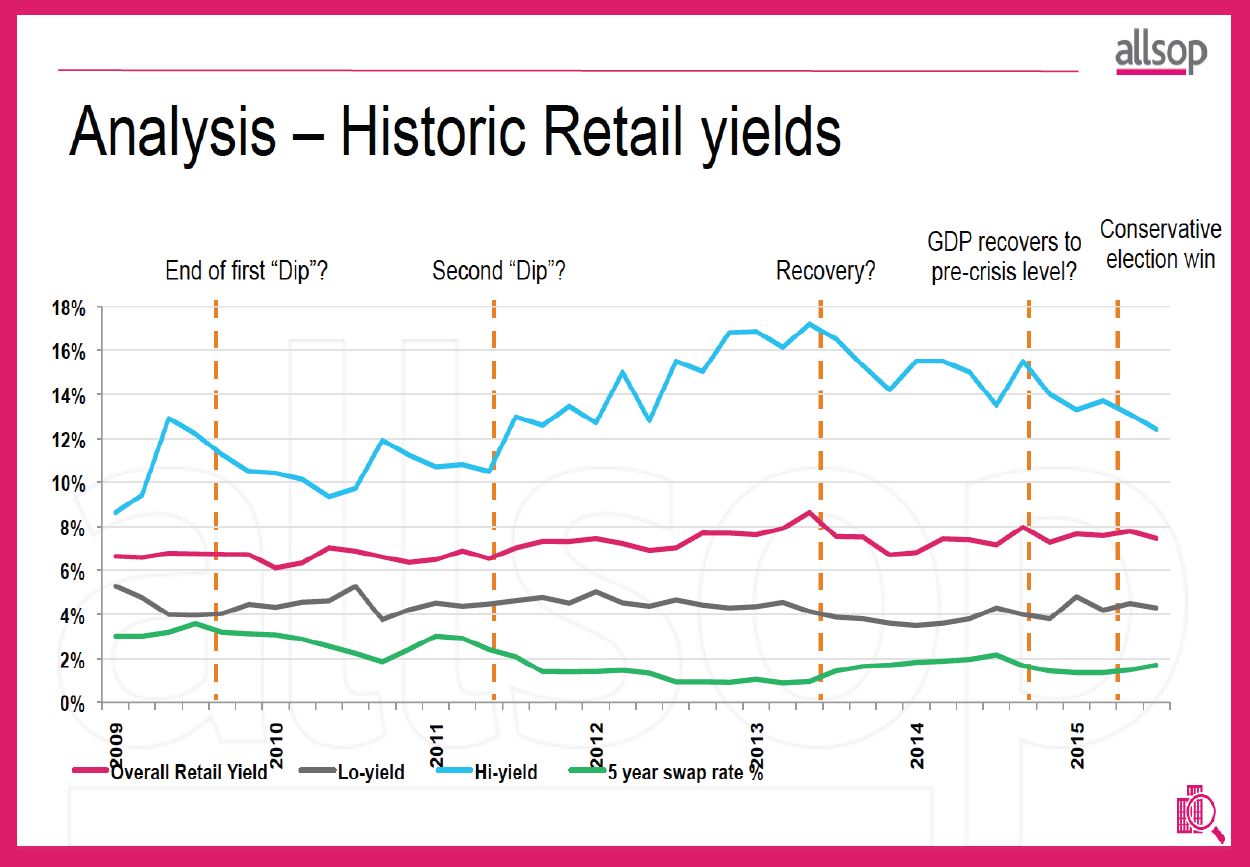

He talked about a number of interesting concepts, here referring to location by mentioning two identical assets with the same rents which sold for very different prices due to their location. He summed up speculating about interest rates, and reiterating that confidence in the UK economy is benefitting commercial tenants and is also responsible for London’s safe-haven status. He concluded demand had now outstripped supply of investment property.

Will Clough, senior surveyor at Allsop, then continued.

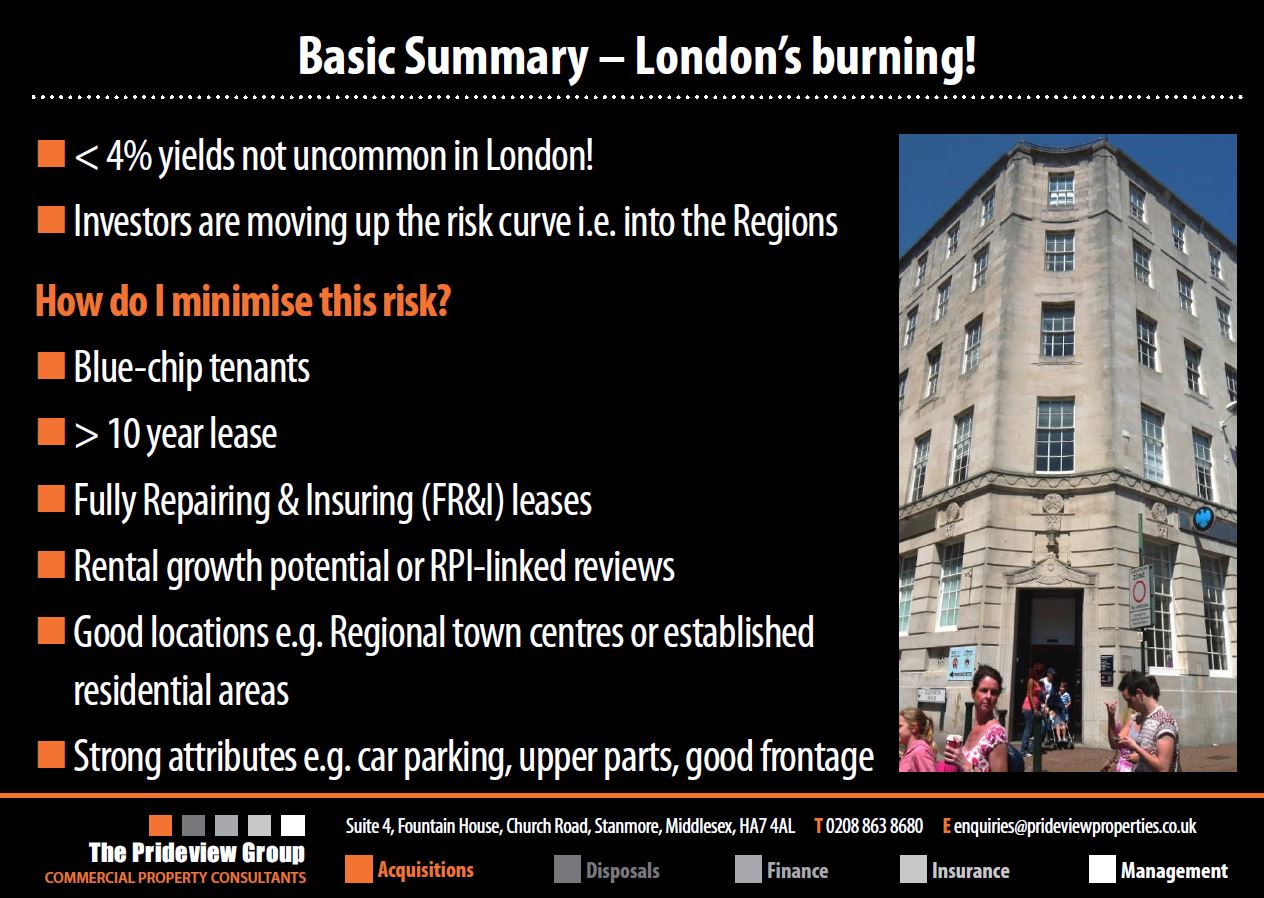

Prideview’s Nilesh Patel then took over, saying Allsop’s fantastic update was a touch act to follow. Nilesh explained that in today’s market with London prices rocketing, investors must look at the regions for investments and he emphasised that finding the right deal is harder than one might think.

Next up was Jesal Patel who walked through two restaurant investments and two convenience stores we have recently acquired, and the differences between those in London and those in the regions. He also gave the example of one development opportunity we have been working on in recent years, which would have been of interest to more experienced investors in the room. Finally up stepped Vishal Patel to conclude the presentation. He talked about a number of convenience stores for sale with 15 year leases which are ideal for SIPP investors. Dinner was then served and investors had plenty of opportunities to meet the Prideview and Allsop teams and discuss commercial property investment in today’s market.

If you would like to learn more about commercial property investing, please contact Nilesh on [email protected] or 0203 113 2142