Our annual Property Investors’ Dinner was a huge success with over 100 private investors assembling to hear the Prideview team and Acuitus, one of the leading commercial property auctioneers, deliver a fascinating presentation about commercial property investment in today’s market. Click here to see the pictures!

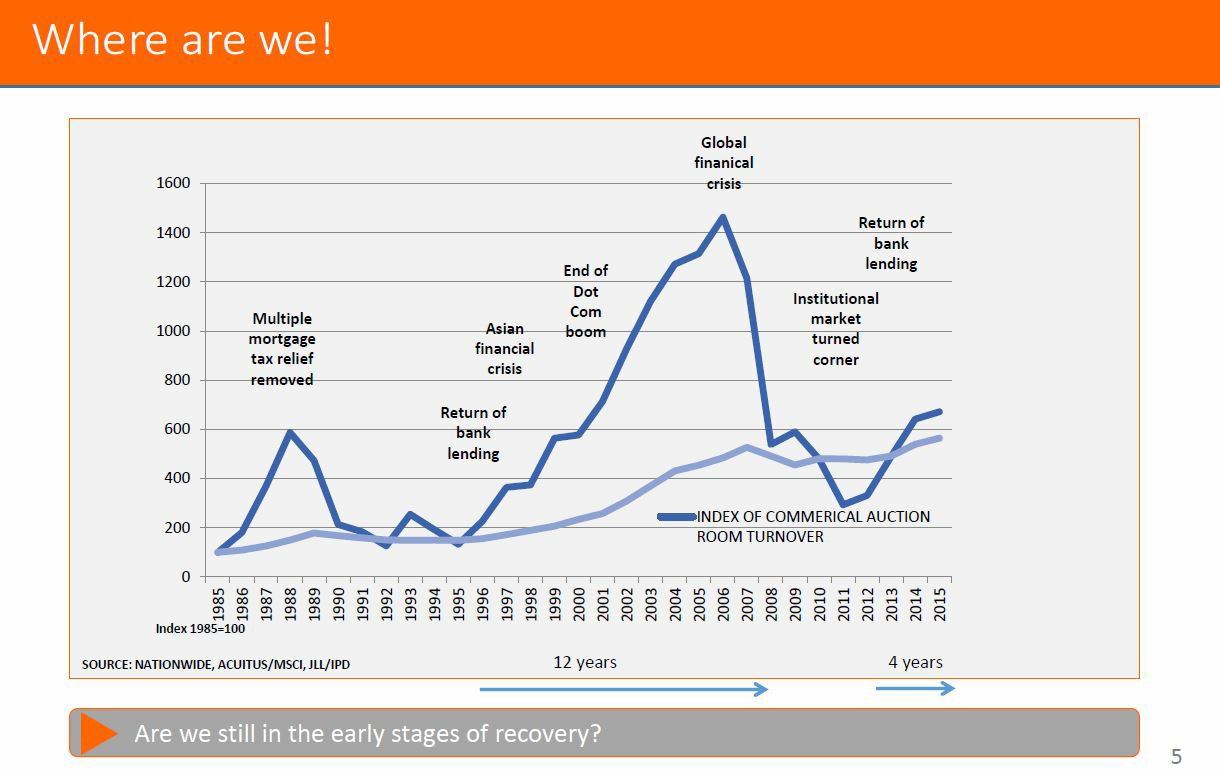

He discussed a recent trend that only seems to have accelerated since Brexit – namely the rising demand for commercial property from private investors. He then ran through a number of recent examples which included some post-Brexit ‘bargains’ from the July auction (e.g. a shop and flat in Wembley which sold for 8%+ in July) and otherwise some rather expensive buys from October (e.g. a lock-up Fish and Chip shop in Greenford which sold for 4.6% in October).

He was able to demonstrate the price difference between similar properties in Greater London and Regional towns by analysing some comparable sub-£1m sales but also ran through a few riskier investments such as a Burger King in Northampton which sold for 9% because the property was over-rented by as much as 33%. He made it clear to the private investors in the room that the commercial property market is not like the residential market – it is not as transparent and rents can fall dramatically, and therefore good advice is worth taking.

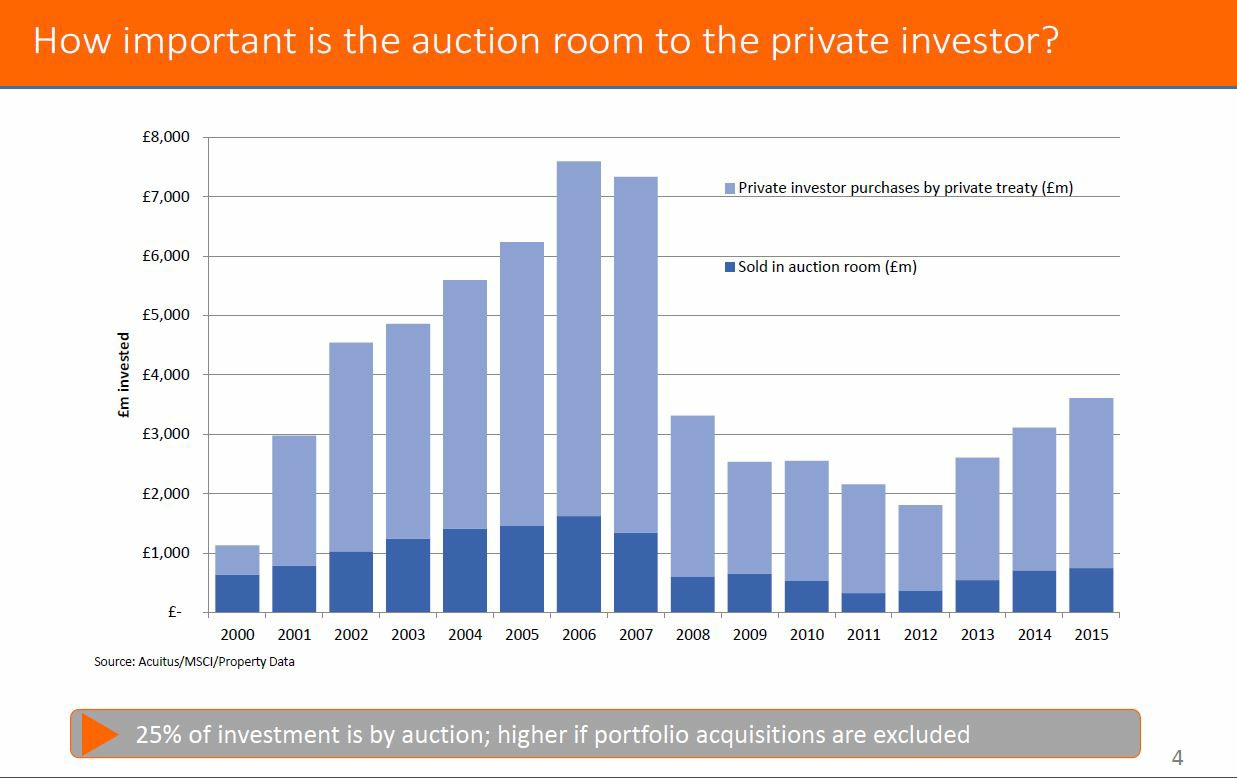

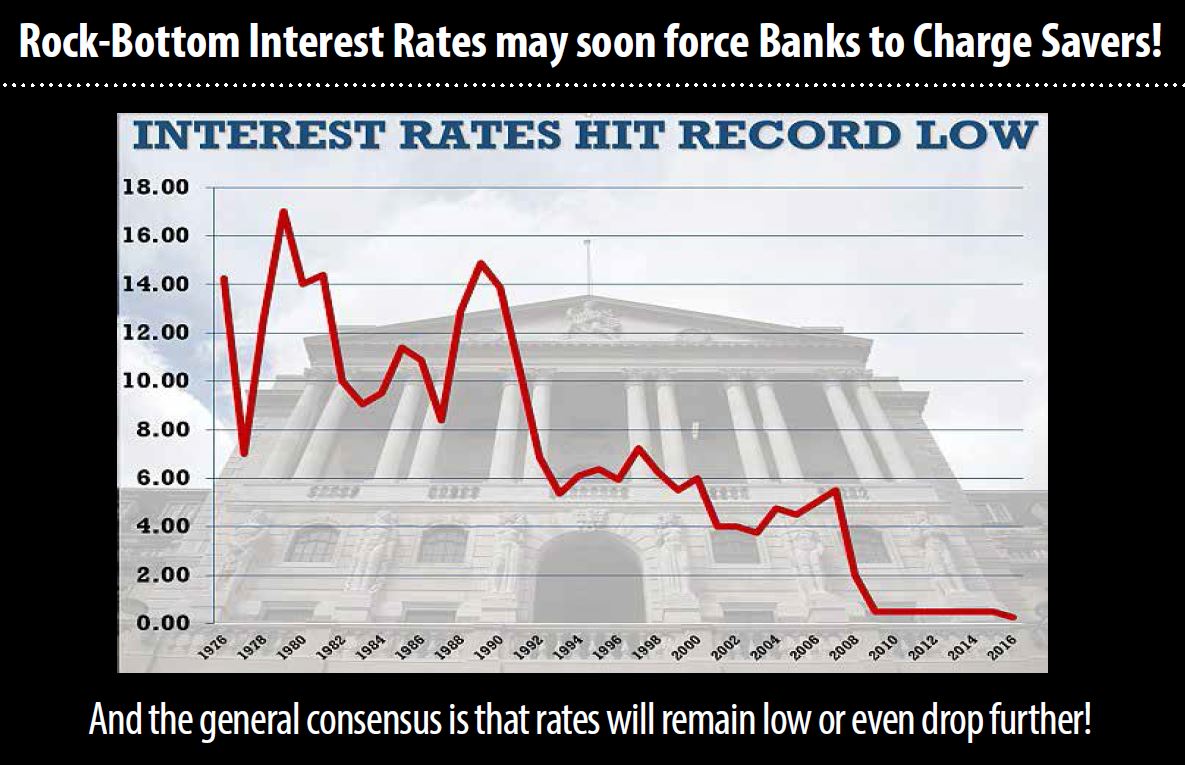

Prideview’s Nilesh Patel then took over, summarising the key trends influence investors’ decision-making in the current market. First up was an explanation of the tax changes to commercial and residential property which have been enacted in 2016, which is well-summarised in a recent post we published here. He then spoke about the recent interest rate cut and how this is forcing many investors to turn to commercial property in the hunt for yield, and also take on cheap finance too if the deal is good enough to pass lenders’ criteria.

Next up was Pritesh Patel who walked through 3 recently completed transactions including a regional blue-chip bank, a regional blue-chip restaurant and an independent hair salon within London’s M25. All sold for ca. £500,000 and a gross yield of ca. 6%. The reasons why varied for each one, but clearly this reinforces the view that this lot size sits nicely with many investors who previously would have looked at buy-to-let property.

The talk was then concluded by Jesal Patel who spoke of about an area we specialise in, namely buying brand new blue-chip convenience store investments within new residential developments, often well before the tenant is trading. Whilst this carries some risk, this can be mitigated by a good lawyer and also enables the investor to secure the deal at an attractive price and gives enough time to raise funds as completion will usually be at least 6 months after exchange. He summarised some of the off-market opportunities we have available now across the country and urged all attendees to ensure their information was correctly registered with us so they could be kept in the loop. Dinner was then served and investors had plenty of opportunities to meet the Prideview and Acuitus teams and discuss commercial property investment in today’s market.

If you would like to learn more about commercial property investing, please contact Nilesh on [email protected] or 0203 113 2142