By Nilesh Raj Patel. Published in the Asian Voice’s Finance, Banking & Insurance Magazine in July ‘16. Click here to view the original article

2016, what a year it’s been! First the tax grab on residential property and now Brexit. Commercial property has become the order of the day, as private investors avoid over-taxed buy-to-let property and volatile stock markets in their attempt to generate returns that sufficiently exceed the incessantly low Bank of England base rate.

But our market is far from risk-free and in these uncertain times, one must stick to the fundamentals. Accordingly, I felt compelled to create this checklist, aimed at anyone trying to make a decision on a potential commercial property investment.

You won’t find a deal that ticks all these boxes – prioritise say six or seven that are most important to you and if ticked, do not let that deal slip away!

1. Location, Location, Location!

Regionally speaking, London’s where it’s at with its optimal demographic: a dense and affluent population. But even within London this varies widely, and out in the regions there are numerous, prime towns. The micro-location is perhaps more important – even the worst towns need some commercial property – if yours is on that corner, off that road or next to that station, it will rent all day long.

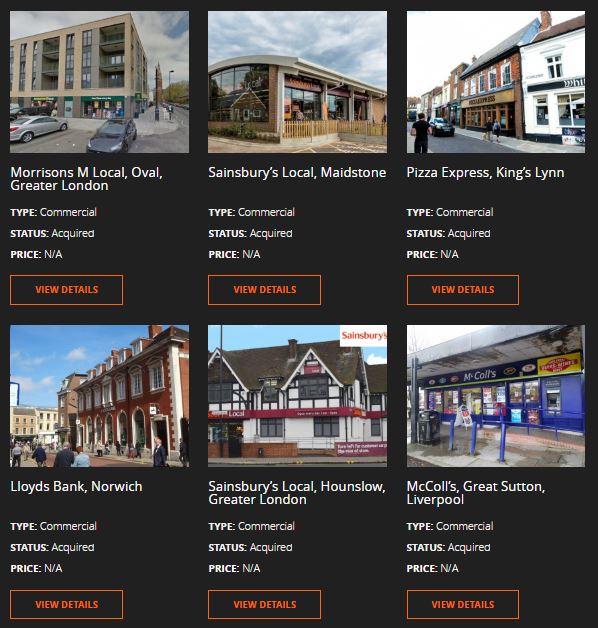

Some of our recent blue-chip acquisitions

2. Tenure: Freehold / Virtual Freehold / Long Leasehold

Owning the Freehold means you sit on the top and have maximum control, now and forever. Whilst a 999 year Virtual Freehold is sufficient for a ‘dry’ investment, for many Freehold is still a must.

3. Tenant Strength: Blue-chip / Multiple / Independent

Tenants of PLC covenant strength comply with their leases and pay rent on time & in full. The rigorous analysis they conduct before signing a lease also breeds confidence. But the bigger they come, the harder they fall, so ensure you are satisfied with the nature of their business too, be that supermarkets, banks, pubs etc.

4. Unique Property Attributes

Everyone knows what to expect from a typical shop, but some have certain features which make them a cut above e.g. car parking, prominent frontage, and best of all those that are purpose-built.

5. Sustainable Rent Level

A property let at a sustainable level is one that can be reviewed and re-let more easily, it will deliver long-term. Some investors prefer for rental growth to be written in stone via fixed or inflation-linked uplifts, but that this can lead to a property becoming over-rented vis-à-vis market rents.

6. Lease Length & No Breaks

All investors like a long lease; unfortunately in the evolving retail market tenants don’t. As a rule, never look beyond a break clause, as for lending and investment purposes, the ‘term certain’ (the time until the break) is what matters. 10 years’ term certain is ideal, 15 years’ the gold standard.

7. No VAT

To be clear, buying a VAT property does not mean you pay VAT on the purchase price – there is a simple process to avoid that, which many buyers don’t get. But it does mean you must charge VAT on the rent (and account for it), which this may affect future tenant demand given not all tenants can charge VAT on their sales (e.g. Banks).

8. Upper Parts: Whole Building / Lock-Up

Most commercial properties come with upper parts, usually ancillary, office or residential accommodation. Generally it’s preferable to own the whole building, not just to diversify your income but in order to maintain control of it. In London many floors of flats won’t be affordable and a “lock-up” ground floor unit usually suffices as an investment given the strong tenant demand.

Some properties have potential that can be unlocked one day – perhaps they sit on a large plot that could be developed or maybe part or all of the property could be converted to an alternative use. It’s always good to have a plan B should the tenant vacate.

10. Financeable

Lending is only really available for quality properties i.e. which tick many of the above boxes. But financeable properties offered for sale within a suitable timescale (ca. 6 weeks) will be accessible to more buyers and will be more expensive than those for the quick, cash buyers.

Taking all the above into account, the most important factor is the Price and therefore your Yield / Return. If you are getting something within your budget at market value, just satisfy yourself you are not buying at the top of the market – because it is cyclical. If it’s under-value, exchange ASAP and if it’s over-value, it either ticks all your boxes or you really really must need to get your money working!

If you want sight of some opportunities that tick most of these boxes or would like to discuss any of these areas in more detail, give me a call on 0203 113 2142 or email me at [email protected] so I can understand your requirements and register you on our active investors mailing list.