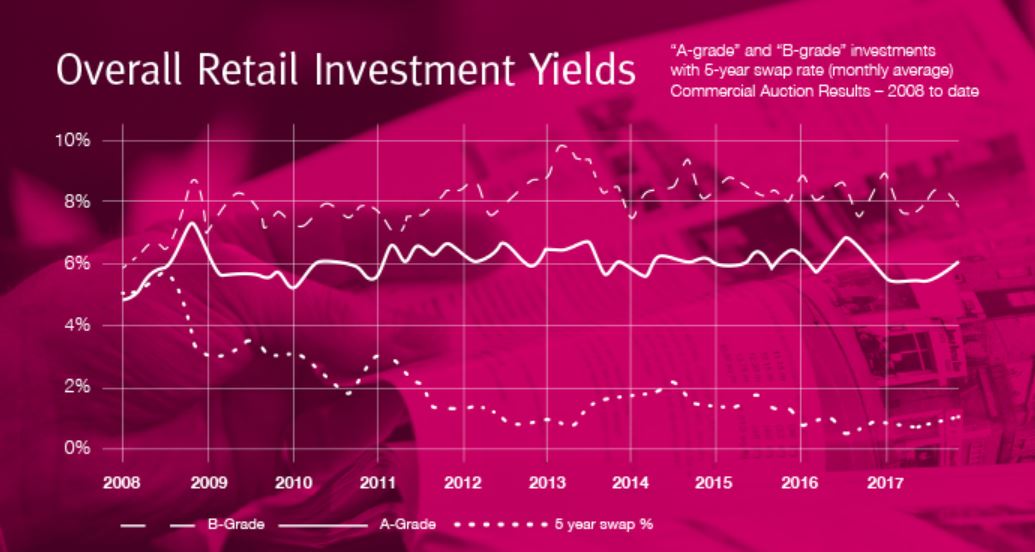

Firstly, Happy New Year from all of our team! 2017 certainly beat expectations for commercial property investment given the ongoing Brexit debate, weak (but strengthening) pound and rising interest rates. You can read a detailed analysis of the auction market specifically here, published by Allsop. Their below summary of historic yields for A and B grade investments clearly shows that 5-6% continues to be roughly what you can expect if buying a quality commercial investment at auction.

The below blue-chip investments are representative of the pricing for quality investments in the current market. Do get in touch if you are looking to invest in auction or privately in 2018. We are marketing a number of lots in auction in February including Papa John’s in Newport (£155k+, 7.8%) and McDonald’s in Leicester (£2m+, 5.5%).

Lot 18 – McColl’s & Flat, Liverpool

Description: Freehold convenience store with self-contained flat above

Tenancy: Let to Martin McColl Ltd for 20 years from 27/02/2011 for £29,810 FR&I

Location: Secondary commercial location in a residential suburb 3 miles from Livepool

Guide Price: £435,000+ (6.9%)

Result: Sold Prior (ca. 6%)

Our comment: Properties let to McColl’s on long leases (this one has 13 years to go) are always popular with private investors. Mccoll’s tend to occupy smaller newsagent-cum-convenience store units in ‘secondary’ residential areas, meaning the lot sizes tend to be below £500k unlike other Blue-Chip convenience stores, and some like this one come with flats above. We acted for the sellers on this lot, who were comfortable guiding this at a very attractive yield close to 7%. Interest was strong prior to auction and we accepted an offer prior closer to (but above) 6% gross.

Lot 2 – NatWest, Streatham, Greater London

Description: Virtual Freehold ground and part 1st floor bank measuring ca. 4,000 sq.ft.

Tenancy: Let to Natwest until 11/12/2028 for £50,000 p.a. FR&I

Location: Busy High Street location in a South London suburb

Guide Price: £950,000+ (5.3%)

Result: £1,040,000 (4.8%)

Our comment: We sounded out a few of our private clients about this investment prior to auction due to its excellent fundamentals (10 year + lease, London location and sustainable rent) and its realistic guide price. The eventual buyer, who first came to us last year looking for long lease Blue-Chip investments yielding 8% (but since realised such deals rarely come through), had to bid a bit more than he hoped (ca. £1m) but will not lose sleep over having picked up such a solid, long-term investment for his family.

Lot 13 – Boots, WH Smith & Specsavers, Cosham

Description: Freehold blue-chip parade investment with uppers

Tenancy: Units (with uppers) let for 7, 3 and 4 years respectively for a total rent of £91,650 p.a.

Location: High street location in a town just outside Portsmouth

Guide Price: £1.25M + (7.3%)

Result: £1.31M (7.0%)

Our comment: We acted for the seller on this parade expecting strong demand from more sophisticated investors looking for an investment with medium-term asset-management or even development potential. In the end it sold in the room at what we think was a great price for the buyer given they have several options available to them including holding as is, renegotiating the leases and taking back the upper parts to explore residential conversion.

If you are looking for a commercial property investment by auction or privately we can assist. We have a number of off-market investments available now, and will be actively buying and selling in the upcoming February auctions. Please contact Nilesh to discuss further or Register with us here.