Receivership lots drop to 7% as retail makes up 70% of Allsop sales

Published in the Estates Gazette on 29th January 2016

Allsop said convenience was the retail sector least disrupted by changing consumer habits. It said: “Betting shops or banks may make cost savings by moving online, but a convenience store’s main selling point will ensure a need for a physical presence.” Other shrewd investors, said the report, will target light industrial and laundrette lots, both of which come under the new permitted development rights regime, meaning they can be converted to residential without planning permission.

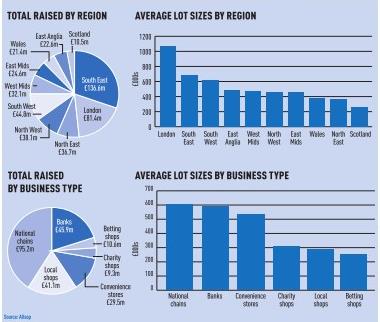

The national picture for commercial auctions showed the South East delivering the biggest receipts, raising almost £137m, with London offering the largest average lot sizes and keenest yields (see below). The lowest-yielding region outside London and the South East was the South West, which delivered an average yield of 7.5%. Yields were highest in Scotland at 9.8%.

Receivership lots, which made up almost one-third of commercial auction sales three years ago, now account for just 7% of sales. In contrast, property companies have increased their activity in the auction room, accounting for 65% of Allsop’s commercial sales last year, up from 59% in 2014.

The above article vindicates our acquisition strategy for many of our private clients, which has been to buy convenience stores in South England. If you are looking for similar investments, we specialise in acquiring blue-chip convenience stores both privately and in auction so don’t hesitate to contact Vishal to discuss further. To read Allsop’s full 2015 review, click here