Since the Covid 19 pandemic hit our shores, the UK has experienced significant change, with the traditional high street being one of the most affected sectors. The Government has recently introduced some major changes to planning regulations including a rejigging of Use Classes Order and the General Permitted Development Order to name but two. Read on for Director Mark Hoffman’s summary of and explanation of the implications of these on investors.

Changes to the Use Classes Order

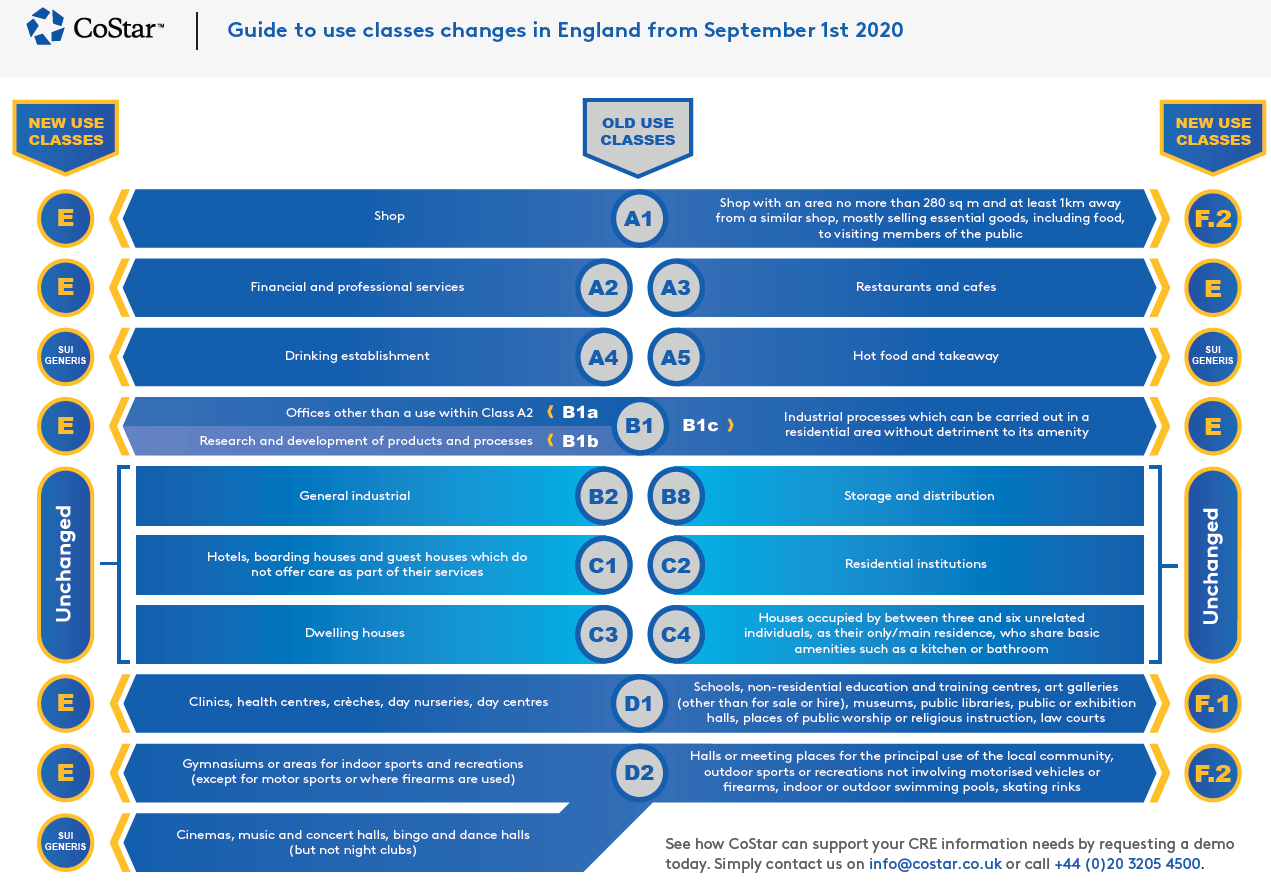

Under the historic Use Classes Order (The Town and Country Planning (Use Classes) Order 1987) there were 5 ‘A’ categories relevant to the High Street:

- A1 – Shops (including retail warehouses, hairdressers, undertakers, travel and ticket agencies, post offices, pet shops, sandwich bars, showrooms, domestic hire shops, dry cleaners, funeral directors and internet cafes)

- A2 – Financial and professional services (including banks and building societies, professional services (other than health and medical services) and including estate and employment agencies. It does not include betting offices or pay day loan shops – these are now classed as “sui generis” uses)

- A3 – Restaurants and Cafes (for the sale of food and drink for consumption on the premises)

- A4 – Drinking establishments (pubs, wine bars but NOT night clubs)

- A5 – Hot food takeaway

Historically if a property had A1 use it would need a full planning application to change its use to any of the other ‘A’ categories. However if a property had A2/A3/A4/A5 then it would be able to trade as A1 without the need for planning permission.

In response to the significant and ongoing impact on the High Street, the Government has announced changes to provide greater flexibility in use class WITHOUT the need for planning permission. From September 2020 there will be a new class ‘E’ (Commercial, Business and Service) which will REPLACE:

- A1 – Shops (including retail warehouses, hairdressers, undertakers, travel and ticket agencies, post offices, pet shops, sandwich bars, showrooms, domestic hire shops, dry cleaners, funeral directors and internet cafes)

- A2 – Financial and professional services (including banks and building societies, professional services (other than health and medical services) and including estate and employment agencies. It does not include betting offices or pay day loan shops – these are now classed as “sui generis” uses)

- A3 – Restaurants and Cafes (for the sale of food and drink for consumption on the premises)

- B1 – Business (Office other than a use within Class A2, R & D of products or processes or any industrial process which can be carried out in any residential area without causing detriment)

- D1 (part) – Clinics, Health Centres, Creches, Nurseries

Which will mean that changes to any use within that list will not require planning permission. According to Landmark Chambers’ planning barrister, “Class E is one of the most significant deregulatory steps in the English planning system for decades.”

There will also be a new Class F 1 and F2, which will provide for change of use only within each class.

- Class F1 is for learning and non-residential institutions, previously classed as D1. Specifically for the provision of education; for the display of works of art (other than for sale or hire); as a museum; as a public library or public reading room; as a public hall or exhibition hall; for, or in connection with, public worship or religious instruction; as a law court.

- Class F2 is for local community use. Specifically, any use as a shop mostly selling essential goods, including food, to visiting members of the public in circumstances where) the shop’s premises cover an area not more than 280 metres square, and there is no other such facility within 1000 metre radius of the shop’s location; a hall or meeting place for the principal use of the local community; an area or place for outdoor sport or recreation, not involving motorised vehicles or firearms; an indoor or outdoor swimming pool or skating rink.

Cinemas, concert halls & bingo halls (formerly D2), pubs & drinking establishments (formerly A4) and takeaways (formerly A5) will become a sui generis use with no permitted changes.

So what does all this mean for investors?

Analysis from Savills believes “the flexibility afforded by the new Class E will make it easier to re-occupy vacant shop premises in town centres for alternative uses identified in Class E without the need for planning permission” and will help accommodate the “dilution of the retail function of the centre”. Savills also point out that interestingly the policy states “a building in the Class E may be in use for a number of uses ‘concurrently or at different times of day’ suggesting there can be complete flexibility within the Use Class.” Accordingly we expect many tenants to adopt this flexibility of provision.

Aston Rose offers some thoughts as to who the actual winners and losers of these changes might be. Winners could include Shopping Centre owners, who will now face fewer planning blockages when leasing out units and Light Industrial owners, who can now let their units to a wider range of tenants such as fitness studios, offices, dark kitchens or soft play areas. Losers may include landlords in prime areas of ‘premium’ uses such as restaurant consent, which is now easier to obtain and owners of flats above shops who could find they now sit above a restaurant.

Investment values are intrinsically linked to the success of the occupational tenant. This law certainly helps tenants, giving them the flexibility to find the right properties for their businesses, and this should feed upwards to the landlord, generally speaking.

Changes to Permitted Development Rights

The recently published Planning Policy paper sets out comprehensive reforms to England’s historic planning system. Under the new rules, existing commercial properties including newly vacant shops, can be converted into residential housing more easily in an effort to kick start the construction industry. It is important to note that this does not include pubs.

It will now be easier to build residential above commercial properties – with rights granted for the upwards extension of commercial buildings (office and retail) for residential use (office and retail) by one to two additional storeys to be added, based on a number of conditions being satisfied. The aim is to promote the the densification of town centres, with residential uses providing economic support for the more traditional town centre uses.

Another change is the right for former B1 properties (Office other than a use within Class A2, R & D of products or processes or any industrial process which can be carried out in any residential area without causing detriment) to be redeveloped into freestanding C3 blocks of flats or single dwellings, provided they are detached properties amongst other conditions. Previously, Permitted Development rights in this case allowed conversion rather than redevelopment of such properties.

We still expect more flexibility to be introduced into the planning system and clearly there are a number of conditions and overriding factors that will limit that application of these changes, but it is certainly a positive step which will breathe life into existing investments and buildings earmarked for sale. If you believe your property is affected by this, or you are looking for buildings where residential conversion or development is realistically possible, please contact me via the form below to discuss further.