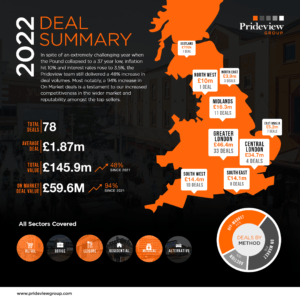

Nevertheless, thanks to our unique dealing methodology, the Prideview team still delivered a substantial 48% increase in deal volumes.

A few key observations include:

- A 94% increase in On Market deals done – testament to our increased competitiveness in the wider market and reputability amongst the top sellers.

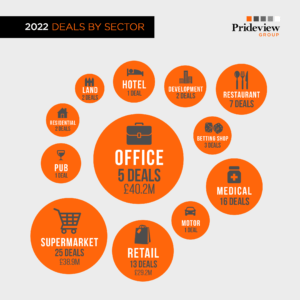

- Offices became our number one sector for the first time (£40.2m). This was not to do with us doing fewer deals in our traditionally strongest sector, Supermarkets, as we also doubled those volumes to £38.9m, but rather due to our stated push at the beginning of 2021 to deliver more in the £3 – £10m market. At an average price of ca. £8m, this is exactly where our 2022 office deals sat.

- 2022 continued the increased focus on London and the South East with 65% of deals done compared to almost 50% of deals in 2021 (note that in 2020 the Midlands represented our most popular region).

Mark Hoffman, Investment Director at Prideview, commented:

We are delighted to be competing much more in the On Market Private Treaty field and are mandated by a number of family offices, funds and propcos to secure assets in the £3m – £10m category and beyond. What our increased deal volumes do not show are the numerous occasions where our cash buyers were underbidders on substantial Private Treaty deals and with many similar opportunities in 2023 likely to come down in price, we urge all agents and sellers with deals stalling or deals planned for market to reach out to us for a meeting, call or drink in early 2023 to discuss further.

-

< £500k

-

£500k – £1m

-

£1m – £3m

-

£3m – £10m

-

£10m +